The Flip 2K5

Or, “Yahoo bought everyone on my buddy list, and all I got was this t-shirt”.

Following up on the discussion about Web 2.0 from last week, the only thing as glaring as who was missing from the room was the talk of a new bubble. I can’t even count how many blog posts and skeptical articles I read referring to Bubble 2.0.

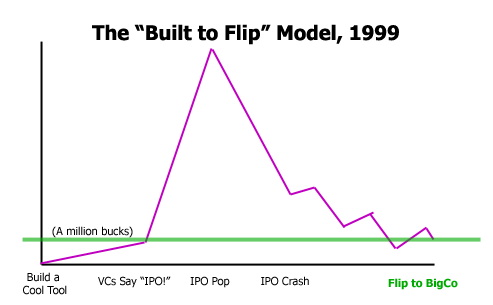

I don’t really have an opinion either way if there’s another bubble inflating right now, but I think it’s interesting to take a look at the companies that have already flipped and to compare them to the acquisitions after the deflation of the Web 1.0 bubble. Keep in mind, during the pre-Y2K bubble, the goal was to IPO and become fabulously wealthy; Indeed, being “built to flip” was a near-epithet five years ago. (Whatever happened to that Pyra company, anyway?)

Interestingly, most bubble companies, especially those with unsustainable models, ended up flipping to one of the big players (AOL, Microsoft, Yahoo, eBay, later Google) or one of the then-big players (Lycos, Excite, et. al). This would happen after the initial run-up in stock value, and would end with a crash or a slow slide, after which the VCs made money, founders made a little bit of money, and everybody else pretty much ended up underwater.

Picking an aribtrary payoff of a million bucks for a founder, a founder’s share over time looked something like this: (CAUTION: Bogus infographics ahead!)

In the objective, global sense, the founders should be happy they’re (nominally) millionaires. But they likely ended up bitter they didn’t cash in huge like the guy they had a meeting with the week before. Some of those folks are trying again in Web 2.0, some of them aren’t. But in the meantime, lots of clever new folks have built cool new apps. The PowerPoint decks for these new apps feature buzzwords like “AJAX”, “Ruby on Rails”, “Tags”, and “Google Maps Mashup” whether they’re credible or not.

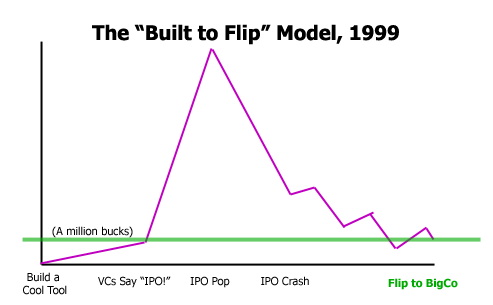

But this time, the VCs don’t come swarming in. Some folks are bootstrapping their services and some are taking angel funding (that means a rich friend of the company gives you money). So, instead of being pushed to do a huge IPO with a huge return, a lot of these people are more than happy to be acquired rather than shoot for a ridiculously huge IPO. I think part of the reason, for at least some of them, is that new regulations like Sarbanes-Oxley add some friction to the process of getting ready to go public. Nothing wrong with that, and it’s also good that some of the little services realize they’d be happier with a corporate home than trying to grow into a giant company on their own.

The math, though, is where it gets fun. I think Web 2.0 companies that have flipped/are flipping to big companies are ending up with almost the same end result for founders. It’s still a decent amount of money, there’s just a different path to get there:

So, meet the new flip. Same as the old flip. Just a theory.